Grow & Share Together

Wednesday, April 1, 2015 at 1:11PM

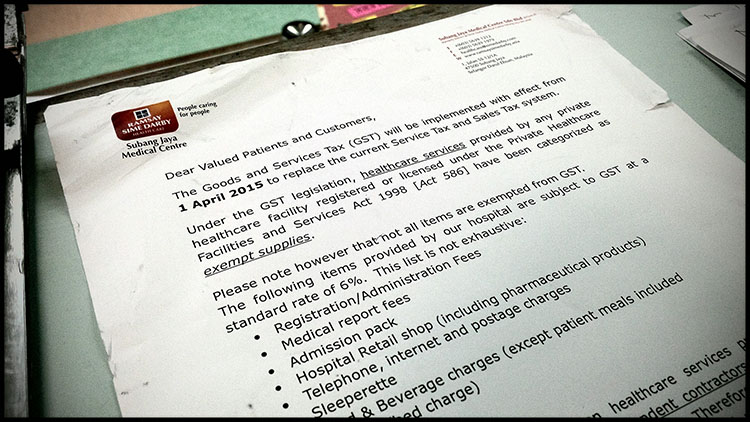

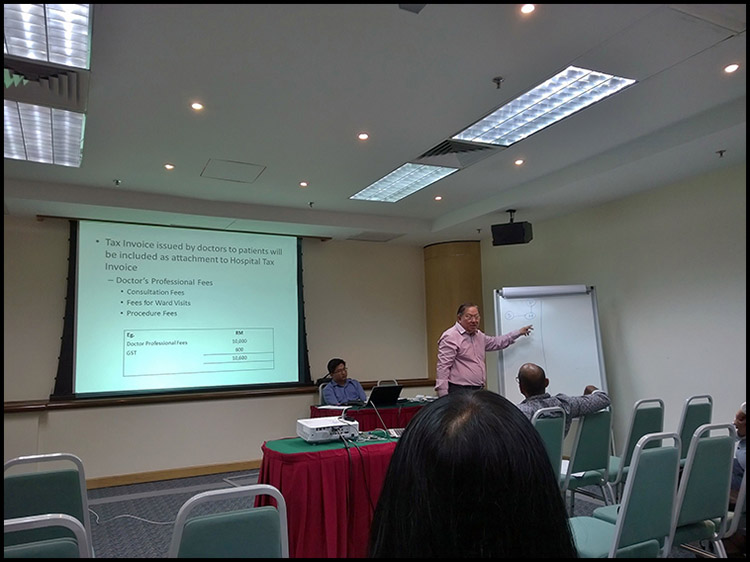

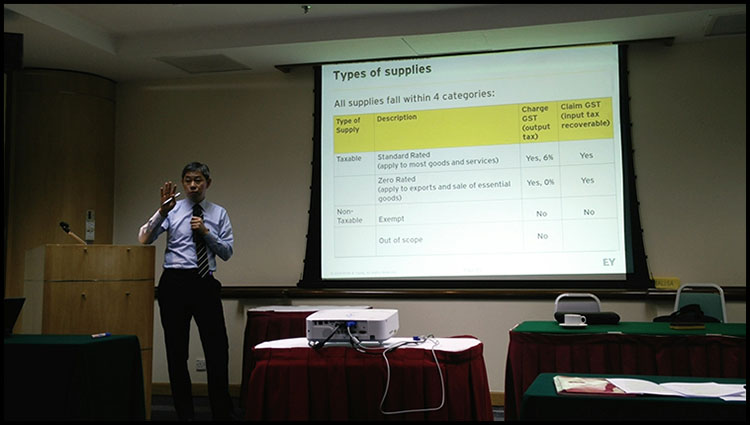

Wednesday, April 1, 2015 at 1:11PM Being a good citizen that I was, my first ever physical contribution to the GST happened this morning. Right after my ward round, I went to my favourite breakfast place and duly contributed.

The had a new till machine install to capture the GST portion of the bills which I was sure would help with the Customs payment later. Took a bit longer than usual but the staff finally figured out what to do. I lost my receipt though. Damn!

Where's everybody?Back to the lounge during lunchtime, I wondered what was going on. The room was practically empty? Are there some makan thing going on which I didn't know. Or was it that the clinics were all cancelled and everybody were on leave?

Where's everybody?Back to the lounge during lunchtime, I wondered what was going on. The room was practically empty? Are there some makan thing going on which I didn't know. Or was it that the clinics were all cancelled and everybody were on leave?

Doctor's Lounge,

Doctor's Lounge,  GST,

GST,  SJMC in

SJMC in  Diary

Diary

Submission Done

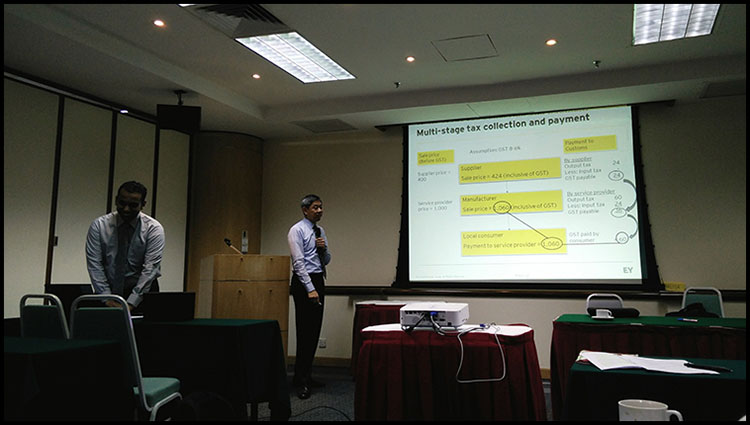

This was going to be my 3-monthly ritual form now on. Submitting the GST, which was due at the end of this month. The paperwork alone was a bit of a nightmare, but hopefully I got everything in order. The fact that the under the law, it carried a criminal penalty did not help matter.

But the Customs Department had streamlined its process and payment had been less of a pain. I was able to do everything online, with the payment linked straight into my bank account. I didn't have to physically open my chequebook or take a trip to the bank for this one.

I must say I had been having sleepless nights thinking about all this and certainly its combination with the economic downturn was starting to take its toll. Prices were all going out while salaries remained stagnant, or in some cases coming down for those unfortunate enough not being able to retain their job. Best to take stock during this time of economic downturn to plan ahead ....